IRS 1099-R

What is a 1099-R form?

Like the W-2 you receive when you’re employed, retirees have their own version of income reported to the IRS. This is a tax form called a 1099-R. Also like a W-2, the 1099-R is released annually after the end of each year you collect retirement income. Usually the previous year’s 1099-R is available before the end of January. Every year, DRS releases a news article as soon as we know the date your 1099-R will be available.

Where do I get my 1099-R form?

View, print or download your 1099-R tax forms through your DRS online account. Hard copies of the form will be mailed by the end of January.

You could get more than one 1099-R form

You get a separate 1099-R for each type of retirement income you receive. For example, if you are a retired PERS Plan 3 member withdrawing money from a DCP savings account, you’ll receive a separate 1099-R for your pension account, your Plan 3 investment account and your DCP investment account. You would access your DCP and Plan 3 investment account forms by selecting Plan 3 or DCP through your DRS online account.

You might receive more than one 1099-R if you:

- Retired from more than one retirement system

- Reached age 59½ during the tax year

- Are receiving your own retirement benefit and a survivor benefit from someone else

- Are receiving your own retirement benefit and a payment resulting from a divorce

- Received a retirement benefit and a refund of contributions within the same tax year

Where can I find more information about 1099-R forms?

Guide to understanding your 1099-R

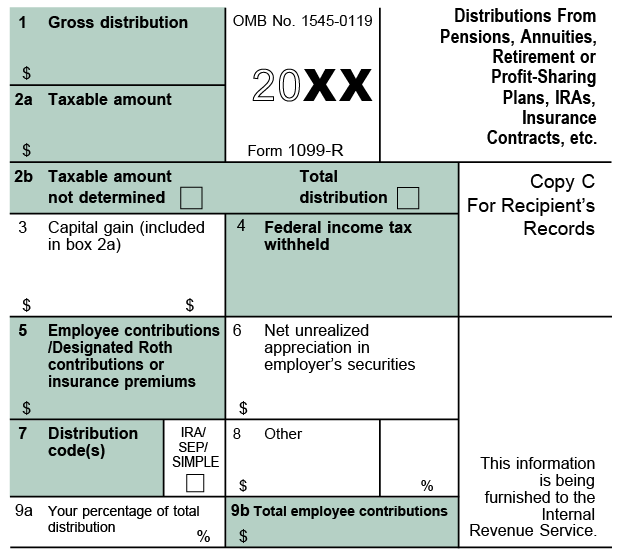

This is an example of a 1099-R tax form. For questions about your 1099-R, contact your tax advisor or the IRS at 800-829-1040.

1 Gross distribution: The total amount we paid you during the tax year.

2a Taxable amount: The taxable portion of Box 1. If this box is empty, see 2b.

2b Taxable amount not determined: If this box is checked, we did not have all of the information needed to calculate your taxable amount. See IRS publication 575, Pension and Annuity Income.

2b Total distribution: If this box is checked, the distribution you received closed your account.

4 Federal income tax withheld: The total amount of federal income tax withheld during the tax year.

5 Employee contributions: Any after-tax contributions returned to you, free of taxes, as part of your pension benefits. Examples of after-tax contributions you may have made would have been for work done prior to 1984 or purchases of credit to DRS where you paid with a personal check.

7 Distribution code: The code identifying the type of benefit (retirement, disability, beneficiary, etc.) you received in the tax year. See the end of this page for a list of the distribution codes.

9b Total employee contributions: The total amount of after-tax contributions you paid to your retirement system while working. We use this to determine the after-tax contribution amount shown in Box 5. This amount is only shown during your first year of retirement.

Distribution codes used in Box 7

The following codes identify your distribution:

1: You are either:

- Under the age of 55 and withdrew your retirement contributions; or

- A retiree under age 55 who withdrew an annuity at retirement without rolling it over to an IRA, qualified plan or tax-sheltered annuity.

2: You are either:

- Over the age of 55, but under 59½ and withdrew your retirement contributions; or

- A service retiree who is younger than 59½.

3: You are:

- Receiving a disability retirement.

4: You are:

- A beneficiary, survivor or estate receiving payment(s) from a deceased member or retiree’s account.

7: You are:

- Receiving a service retirement and you are over the age of 59½.

G: You:

- Directly rolled your payment into an IRA.