TRS Plan 2

Teachers’ Retirement System (TRS) Plan 2 is a 401(a) lifetime retirement pension plan available to public employees in Washington. You and your employer contribute a percentage of income to fund the plan.

Your contributions

TRS Plan 2 employee contribution rate: 8.06%

This is the percentage of your salary that goes toward your pension retirement income. More about contributions.

See a live or recorded Plan 2 webinar.

How much will your pension be?

Estimate your retirement benefit in minutes using the personalized Benefit Estimator in your online account. Your total pension amount is based on your years of service and your income. See more about how we calculate your benefit.

How to estimate your benefit

- From the DRS homepage, select the Member Login button in the top right.

- Log in to your online account.

- In the menu bar, select your plan name – such as PERS 2. This will open a dropdown menu.

- Select Benefit Estimator.

- Read how to use the estimator and select Accept & Continue.

- For first-time users, we recommend using the four-step process. This helps you learn how your benefit is calculated.

You can use this tool at any point in your career. You can create an estimate using different factors as many times as you like. This calculator will allow you to see a private preview of what your monthly retirement income might look like.

Years of service

Review your service credit detail through your online account. Service credit is based on the number of hours you work, which your employer reports to DRS. You can earn no more than one month of service credit each calendar month, even if more than one employer is reporting hours you work. A school year spans Sept. 1 through Aug. 31.

You earn 12 months of service credit if:

- You work 810 hours or more, beginning work in September and working at least nine months of the school year

What if you work fewer than 810 hours?

Work between 630 and 809 hours, beginning in September, and working at least nine months of the school year

You earn: Six service credit months (half a service credit for each month) per school year

Work at least 630 hours during at least five months within a six month period during the school year

You earn: Six service credit months per school year

Work 90 or more hours in a month

You earn: One service credit month per month

Work at least 70 hours but fewer than 90 hours

You earn: Half a service credit month per month

Work more than 0, but fewer than 70, hours

You earn: One-quarter service credit month for each month

More information about service credit:

Some items that could affect your service credit:

- Membership in another plan administered by Washington state.

- If you work as a substitute.

Employees of the Washington State School for the Blind, the Center for Childhood Deafness and Hearing Loss, or an institution of higher learning:

If you begin working in September in an eligible position and earn compensation during at least nine months of the school year, you can receive 12 service credit months for the school year if you are compensated for at least 810 hours of employment. Six service credit months can be awarded if you start in September and are compensated for at least 630 hours but fewer than 810 hours during the school year.

If you earn compensation in fewer than nine months of the school year, you will receive service credit based on the number of hours you are compensated for each month.

Your income

The Average Final Compensation, or AFC is the average of your 60 consecutive highest earning months in your career. This could be at the beginning, middle or end of your career. DRS uses your AFC income information to calculate your pension amount. For high income public employees, federal law limits the amount you can contribute toward retirement and limits the benefit calculation. See IRS limits.

TRS Plan 2 formula

2% x service credit years x Average Final Compensation = monthly benefit

Example:

Let’s say you work 23 years and the average of your highest 60 months of income (AFC) is $5,400 per month.

2% x 23 years x $5,400 = $2,484

When you retire, you’d receive $2,484 per month.

When can you retire?

Now that we’ve discussed how much money you can get in retirement, let’s talk about when you can retire. You need 5 or more years of service to qualify for a retirement with TRS Plan 2. Full retirement age is 65. You can also choose to retire as early as age 55, but your benefit could be reduced depending on your total years of service.

You need 5 years of service

With TRS Plan 2, you need five years of service to qualify for a retirement. Once you have five years, you are a “vested” member. Five is the minimum, but you can earn an unlimited number of years to increase your pension amount.

Full retirement

Full retirement is the earliest age you can retire without any reduction to your retirement benefit. For TRS Plan 2, this is when you reach age 65. If you have 30 or more years of service and you are age 62, you can also retire with a full benefit. What if you want to retire younger than age 65 and you don’t have 30 years of service?

Early retirement

If you retire before age 65, it’s considered an early retirement. If you have at least 20 years of service credit and are 55 or older, you can choose to retire early, but your benefit will be reduced. There is less of a reduction (in some cases no reduction) if you have 30 or more years of service credit.

Early retirement – Joined before May 1, 2013

If you retire before age 65, it’s considered an early retirement. If you have at least 20 years of service credit and are 55 or older, you can choose to retire early, but your benefit will be reduced. There is less of a reduction (in some cases no reduction) if you have 30 or more years of service credit.

If you have 30 or more years of service and you are age 62, you can retire with a full benefit under the 2008 ERF.

How does retiring early affect my monthly benefit?

When you retire early, your monthly benefit amount is reduced to reflect that you will be receiving your pension payments for a longer period of time. The amount of the impact depends on the amount of service credit you have, the date you retire and your age. (See “Early retirement benefit formulas” below.)

If you retire early with 20 – 30 years of service credit, your monthly benefit is reduced by a factor that is based on your average life expectancy. Early retirement factors are subject to change based on State Actuary figures. The reduction is greater than if you retire with at least 30 service credit years.

Early retirement factors

Actuarial early retirement factors, for those with less than 30 years of service, vary by system and plan and are updated at least every six years. See current early retirement factors for Plan 2 members with at least 20 years or Plan 3 members with at least 10 years of service.

- Plan 2: Need at least 20 years of service credit to qualify

- Plan 3: Need at least 10 years of service credit to qualify

Early retirement factors for less than 30 years of service

| Retirement age | Factor |

|---|---|

| 55 | 0.4092 |

| 56 | 0.4450 |

| 57 | 0.4844 |

| 58 | 0.5280 |

| 59 | 0.5760 |

| 60 | 0.6292 |

| 61 | 0.6882 |

| 62 | 0.7538 |

| 63 | 0.8269 |

| 64 | 0.9085 |

Early retirement factors for 30 or more years of service

| Retirement Age | 2008 ERF |

|---|---|

| 55 | 0.80 |

| 56 | 0.83 |

| 57 | 0.86 |

| 58 | 0.89 |

| 59 | 0.92 |

| 60 | 0.95 |

| 61 | 0.98 |

| 62 | 1.00 |

| 63 | 1.00 |

| 64 | 1.00 |

If I retire early, what reductions will apply?

The amount of the reduction to your monthly benefit depends on how much younger than age 65 you are when you retire and the amount of service credit you have. This reduction reflects that you will be receiving your defined benefit for a longer period of time than if you had retired at age 65. Consider how the ERFs are applied in the early-retirement examples shown below.

For more information on early retirement, read Washington Administrative Code 415-02-320.

Plan 2 early-retirement formula

2% x service credit years x Average Final Compensation (AFC) x ERF = monthly benefit

Returning to work could affect your retirement income. See working after retirement.

Early retirement examples

How much difference can early retirement make? That depends on your circumstances, including your wages and age at retirement. Consider the examples below. The administrative factors used in these examples are for illustrative purposes only.

Example 1: Fewer than 30 years

Customer retires Sept. 1, at age 55 with 22 years of service credit.

Their AFC is $3,600. They are retiring early, so using the administrative factor (above table) the monthly benefit is 40.92% of what it would have been at age 65, calculated as follows:

= 2% x 22 years x $3,600 x 40.92%

= 0.02 x 22 x $3,600 x 0.4092

= $648.17 per month

Example 2: 30 or more years

Customer retires April 1, at age 60 with 30 years of service credit using the 2008 ERF.

If they choose to retire under the 2008 ERF, their benefit is reduced by 5% (due to age). The 2008 ERF monthly benefit would be calculated as follows:

= 2% x 30 years x $4,400 x 95%

= 0.02 x 30 x $4,400 x 0.95

= $2,508

Early retirement – Joined on or after May 1, 2013

If you retire before age 65, it’s considered an early retirement. If you have at least 20 years of service credit and are 55 or older, you can choose to retire early, but your benefit will be reduced. There is less of a reduction if you have 30 or more years of service credit.

If you were hired on or after May 1, 2013 and retire early (age 55-64) with 30 years of service credit, your benefit will be reduced by 5% for each year (prorated monthly) before you turn age 65.

How does retiring early affect my monthly benefit?

When you retire early, your monthly benefit amount is reduced to reflect that you will be receiving your pension payments for a longer period of time. The amount of the impact depends on the amount of service credit you have, the date you retire and your age. (See “Early retirement benefit formulas” below.)

If you retire early with 20 – 30 years of service credit, your monthly benefit is reduced by a factor that is based on your average life expectancy. Early retirement factors are subject to change based on State Actuary figures. The reduction is greater than if you retire with at least 30 service credit years.

Early retirement factors

Actuarial early retirement factors, for those with less than 30 years of service, vary by system and plan and are updated at least every six years. See current early retirement factors for Plan 2 members with at least 20 years or Plan 3 members with at least 10 years of service.

- Plan 2: Need at least 20 years of service credit to qualify

- Plan 3: Need at least 10 years of service credit to qualify

Early retirement factors for less than 30 years of service

| Retirement age | Factor |

|---|---|

| 55 | 0.4092 |

| 56 | 0.4450 |

| 57 | 0.4844 |

| 58 | 0.5280 |

| 59 | 0.5760 |

| 60 | 0.6292 |

| 61 | 0.6882 |

| 62 | 0.7538 |

| 63 | 0.8269 |

| 64 | 0.9085 |

Early retirement factors for 30 or more years of service

| 5% ERF | |

|---|---|

| 55 | 0.50 |

| 56 | 0.55 |

| 57 | 0.60 |

| 58 | 0.65 |

| 59 | 0.70 |

| 60 | 0.75 |

| 61 | 0.80 |

| 62 | 0.85 |

| 63 | 0.90 |

| 64 | 0.95 |

If I retire early, what reductions will apply?

The amount of the reduction to your monthly benefit depends on how much younger than age 65 you are when you retire and the amount of service credit you have. This reduction reflects that you will be receiving your defined benefit for a longer period of time than if you had retired at age 65. Consider how the ERFs are applied in the early-retirement examples shown below.

For more information on early retirement, read Washington Administrative Code 415-02-320.

Plan 2 early-retirement formula

2% x service credit years x Average Final Compensation (AFC) x ERF = monthly benefit

Returning to work could affect your retirement income. See working after retirement.

Early retirement examples

How much difference can early retirement make? That depends on your circumstances, including your wages and age at retirement. Consider the examples below. The administrative factors used in these examples are for illustrative purposes only.

Example 1: Fewer than 30 years

Customer retires Sept. 1, at age 55 with 22 years of service credit.

Their AFC is $3,600. They are retiring early, so using the administrative factor (above table) the monthly benefit is 40.92% of what it would have been at age 65, calculated as follows:

= 2% x 22 years x $3,600 x 40.92%

= 0.02 x 22 x $3,600 x 0.4092

= $648.17 per month

Example 2: 30 or more years

Customer retires April 1, at age 62 with 30 years of service credit using the 5% ERF.

If they choose to retire under the 5% ERF, their benefit is reduced 5% for each year before age 65. In this case, they are retiring 3 years early, so 5% three times equals a 15% reduction from 100% (so 85%). The 5% ERF monthly benefit would be calculated as follows:

= 2% x 30 years x $4,400 x 85%

= 0.02 x 30 x $4,400 x 0.85

= $2,244

See a live or recorded early retirement webinar.

Using sick leave to qualify for retirement

You may use up to 45 days of unused sick leave to help you qualify for retirement. Sick leave not cashed out by your employer may be converted into a maximum of two months of service credit. However, this service credit isn’t used in the calculation of your benefit. It can only be used to qualify for retirement.

Using service credit earned outside Washington state

TRS Plan 2 and Plan 3 customers, you can use service credit earned as an out-of-state teacher to qualify for early retirement or increase your monthly benefit. Two programs are available to you, the Out-of-State Service Credit Program and the Public Education Experience Program. You can participate in either or both. View this short video about out of state service credit.

Out-of-State Service Credit Program

The Out-of-State Service Credit Program can help you qualify to retire early, but you will still have a decreased benefit if you retire before age 65.

Using out-of-state service credit might help you qualify for a smaller reduction for early retirement. However, there is only one way to retire early with an unreduced benefit. You must purchase your out-of-state service credit to reach 30 service credit years (see Public Education Experience Program). Additionally, out-of-state service credit isn’t used in the calculation of your benefit. Your retirement benefit payments would be based only on your Washington state service credit.

This program doesn’t benefit everyone. For example, if you need to use more out-of-state service credit than there are years between your intended early retirement and age 65, using out-of-state service won’t increase your benefit.

To find out if using your out-of-state service credit could benefit you, try this calculator.

To be eligible for this program, your out-of-state service must be earned from a public retirement system that covers teachers. You must also be a vested member of TRS Plan 2 or Plan 3 through DRS.

- For Plan 2, you are vested with five years of service credit

- For Plan 3, you are vested with 10 years of service credit, or with five years of service credit with at least 12 months of it earned after age 44.

You can retire as early as age 55 with a reduced benefit.

- For Plan 2, you need 20 or more years of service credit to qualify for early retirement.

- For Plan 3, you need 10 or more years of service credit to qualify for early retirement.

Additional questions:

Is there a cost to use out-of-state-service credit?

No cost.

Is there a limit to how many years of out-of-state credit I can use?

No limit. See this calculator to find out whether applying the years would be beneficial to you.

What if I have credit in multiple out-of-state systems?

You can use or purchase service credit from multiple out-of-state retirement systems. However, if you do, we can only send one bill. Please mark on the form that you have service in more than one system.

What if I’m already receiving, or eligible to receive, my unreduced out-of-state pension?

If you are collecting your out-of-state pension, or if you are eligible for an unreduced benefit from your out-of-state teachers’ pension system, the following applies. You can still use your out-of-state service credit, but you won’t be able to purchase the service using the Public Education Experience Program.

Public Education Experience Program

If eligible, the Public Education Experience Program gives you an opportunity to make a lump sum payment to increase your monthly benefit in retirement.

- Payment required

- Limit of seven years of service credit

- Service credit must be earned in a federal public retirement system or a state system outside Washington that covers teachers

- Based on both Washington state service credit and purchased service credit

- Increases your service credit, which can give you a higher monthly benefit payment

- Can be used to qualify for early retirement or a smaller benefit reduction

- Must be an active member with at least two years of TRS plan 2 or Plan 3 service credit

How much can I purchase?

You may purchase up to seven years of service credit as long as you have at least that much in out-of-state service credit available. Purchases must be made in whole-month increments. Multiple purchases aren’t allowed. For example, if you buy four years of public education experience now, you won’t be able to make another purchase later.

What type of experience qualifies for service credit purchase?

To qualify for the Public Education Experience Program:

- You must have worked as a teacher in a public school in a different U.S. state or with the U.S. federal government

- You must have been granted service credit for that work in a retirement system

- You can’t already be retired from the out-of-state system (collecting a benefit)

- You can’t be eligible for an unreduced benefit from the out-of-state system

How much does it cost to purchase service credit?

If you choose this program, your Washington state service credit as well as your purchased service credit will be used to calculate your monthly benefit. To estimate the cost, use the Buy Back Calculator for Public Education Experience.

You must pay the amount needed in today’s dollars to pay for the increase in your monthly benefit over your lifetime.

How do I pay?

DRS can accept only full lump sum payments. You can make that payment with either a personal or cashier’s check. In many cases, you can transfer funds from another eligible retirement account to pay your bill as well. DRS can’t accept funds in excess of the cost to make your purchase. To learn more about whether you can make such a transfer, contact your account’s administrator. The Internal Revenue Service classifies DRS as a 401(a) account.

When do I pay?

We must receive your full payment before you retire. After DRS receives your form requesting to buy out-of-state service credit, we will send you a bill to make the purchase. You have 90 days from the bill’s issue date to pay it. If you don’t pay it within that time frame, you will need to request a new bill be sent to you.

Can my employer choose to contribute to the purchase?

Yes. Your current employer can choose to help pay for your service credit purchase. Payments sent in by employers must reference your bill number.

Can I purchase this service credit if I am a substitute?

Yes. If you are working as a substitute teacher and your employer is reporting you as an active substitute, then you are eligible.

What if I quit work and withdraw my contributions?

If you separate from employment and request a refund of your contributions, the payment you made to purchase service credit will be refunded to you.

How to apply

Contact DRS to request an Application to Use Out-of-State Service Credit. You’ll need your previous retirement system to complete a portion of the form before you submit it to DRS. If approved for the Out-of-State Service Credit Program, we will send you confirmation. If approved for the Public Education Experience Program, we will send you a bill within 30 days.

Related news

Is it better to retire at the beginning of summer or at the end?

When it comes to retirement for teachers and school employees, a few months can have a big impact and substitutes have health care and return-to-work considerations. Read more…

How do you retire?

When you are within 12 months of retiring, you can start the official retirement process with DRS. First, you request an official benefit estimate. Once you receive the estimate, you complete and submit your application to retire. See this steps to retire with a pension video.

1. Request an official benefit estimate from DRS 3 to 12 months prior to your retirement date. Make this request through your online account or by contacting us. In most cases, we will provide your estimate 5 to 8 weeks before your retirement date. If you haven’t received your requested estimate within 5 weeks of your retirement date, contact us.

Estimates are prioritized by retirement date, which allows DRS to use the most recent information available for you and gives you ample time to submit your retirement application. An official benefit estimate is not the same as the benefit estimator tool available to all customers. To assist your retirement planning any time before or after requesting your official benefit, you can use the benefit estimator tool through your online account.

2. Complete a retirement application at least 5 weeks from the date you intend to retire(once you receive your official estimate). Complete the application online, or request a paper form.

Estimate your retirement income

You can use the benefit estimator tool in your online account to help plan for retirement at any point—while you are still working, and even after you submit an official request to retire. Log into your online account and select the benefit estimator tool to get started.

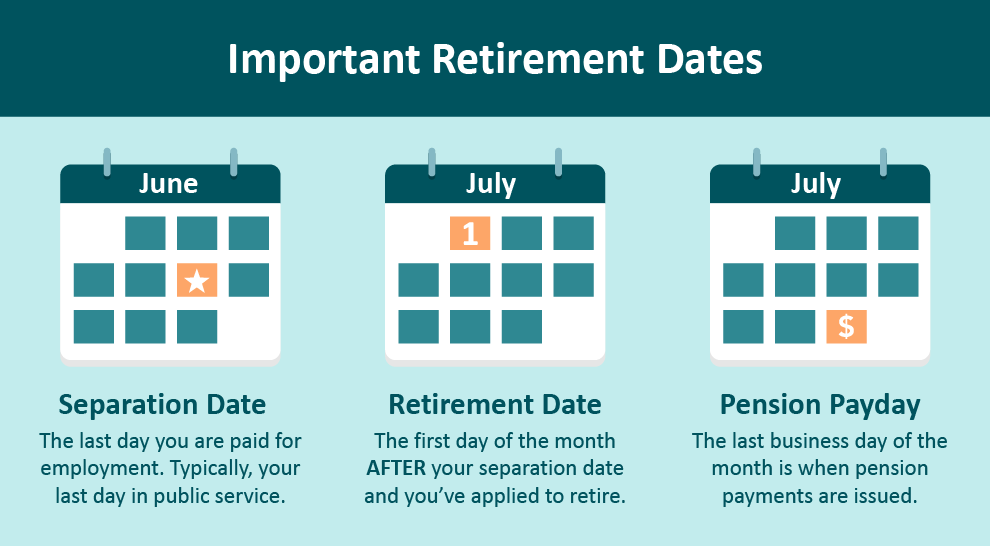

When do you get paid?

Your pension money will be direct deposited into your bank account on the last business day of the month, every month, for the rest of your life. The retirement application has a section for your bank information so your funds will be deposited. Once you’ve retired, you can make any updates to your direct deposit through your online account.

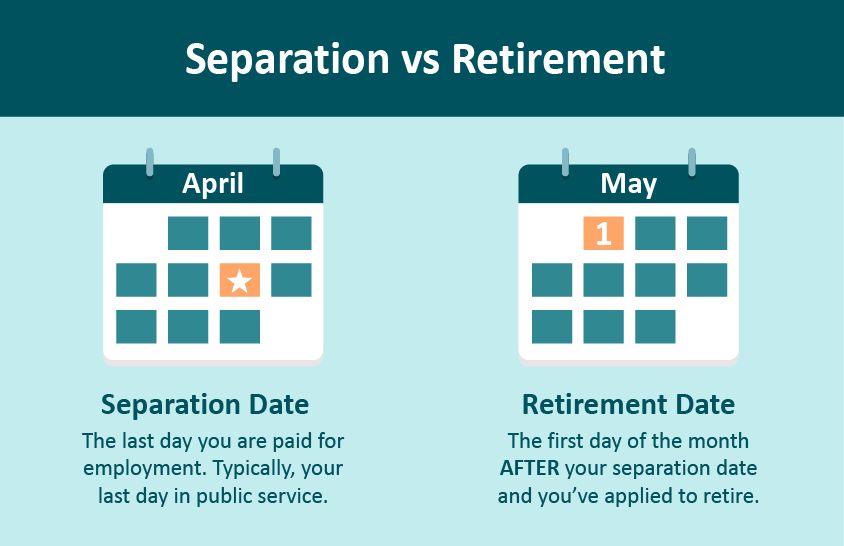

Separation vs retirement

You are retired from DRS when you separate from employment and begin collecting your pension. If you leave public employment, but you are not yet collecting a pension, we consider you separated, but not retired. These instructions assume you are separating and will be collecting your pension (retiring).

See live or recorded retirement planning webinars.

How can you increase your pension amount?

You can increase your pension benefit by increasing your years of service or your income. But when it comes to total retirement income, you have more options.

DCP savings program

The Deferred Compensation Program or DCP is a voluntary savings program you can use to increase your retirement savings. DCP uses many of the same investment options available to Plan 3 members, including investments that are managed for you. With DCP, you control your contribution amount so your savings can grow with you. Saving an additional $100 a month now could mean an extra $100,000 in retirement!

(Example based on 6% annual rate of return over 30 years of contributions.) More about DCP.

Annuity options

What is an annuity?

Annuities are lifetime income plans you purchase.

When it’s time to retire, you have some additional options—options that can change your finite savings into a monthly, lifetime income called an annuity. An annuity is a guaranteed income plan you purchase. The monthly payments you receive are based on the dollar amount you choose to purchase. The annuity will provide monthly payments for your lifetime. The annuities DRS offers are administered by Washington state with investments provided by the Washington State Investment Board.

Is an annuity right for me?

Annuities can provide guaranteed income for your life. And they offer security through a set monthly income which can increase annually if you are eligible for a Cost-of-Living Adjustment (COLA). However, flexibility is not a feature of annuities. Once you set it up, an annuity doesn’t allow you to change the income amount. Once you begin receiving monthly payments, you cannot cancel the annuity.

With annuities, you take money out of market risk and use it to give yourself a monthly lifetime income. Annuities are the only investment withdrawal option that guarantee you will not outlive your account balance.

How do annuities affect my taxes?

Each year you’ll receive a statement that shows the taxable amount of your annuity. DRS is required to withhold a certain amount of federal taxes. If you would like more tax withheld, complete a W-4P form. Without a W-4P, the tax withholding will follow IRS guidelines, using a filing status of single with no adjustments.

For more information about taxes, review IRS Publication 575. You might want to consult a tax advisor when considering purchasing an annuity. DRS and the record keeper are not authorized to give tax advice.

Considering an annuity?

If you are considering purchasing an annuity offered through your plan, be sure to let us know when you request your official retirement estimate. This will allow us to include an annuity estimate along with your retirement estimate.

TRS Plan annuity

This annuity is available to all Teachers’ Retirement System (TRS) members. Unlike purchasing service credit or the Plan 3 TAP annuity, the Teachers’ annuity can be purchased using any of your own funds (except any Plan 3 contributions). With this annuity, your survivor will be the same as the one you selected for your pension payment. If you return to work, this annuity continues.

More about the TRS Plan annuity

When can I purchase?

When you are retiring.

How much does it cost?

Log in to your account and choose “Purchasing Annuity.” Here you can find the monthly increase to your pension for any purchase amount.

Are there limits to the annuity amount I can purchase?

No. There are no minimum or maximum limits.

What funds can I use to purchase the annuity?

You can use any of your own funds, except for any Plan 3 contributions. Funds rolled over from your DCP account must be pretax. If one of your funding sources will be cash or check, the IRS limits the total amount you can pay with this option. The total cash or check must be no more than 100% of your salary in the year of annuity purchase or $70,000 in 2025 (whichever is less).

When does my annuity benefit begin?

Your retirement date or the day after your bill for the annuity is paid in full, whichever comes later.

How often do I receive my annuity benefit?

Monthly.

Can I designate a survivor?

Yes. Your survivor will be the same option you chose for your retirement benefit.

Will I receive a Cost-of-Living Adjustment (COLA)?

Yes. You will receive a COLA up to 3% annually. If you’re a Plan 1 member, a COLA is optional at retirement and your choice will also apply to this annuity purchase.

How do I purchase this annuity?

Request this annuity when you retire online. You can also purchase it when completing a paper retirement application.

Can I cancel the annuity if I change my mind?

In most cases, no. Annuities are fixed income sources. Once you purchase the annuity, you will not have access to the funds you used to make the purchase.

There are two exceptions:

- If you have not completed the annuity purchase, you can still change or cancel the annuity.

- Once you make the purchase, you’ll have 15 days to cancel the transaction. You’ll receive a mailed letter that includes your rescission, or cancel by date.

Will my annuity purchase be refunded when I die?

If you (and your survivor if you selected a survivor option) die before the amount of your annuity purchase has been paid back to you, the difference will be refunded to your beneficiary. This refund option does not apply to the TRS Plan 1 Maximum Option.

What if I return to work?

Your annuity continues.

Purchase service credit

Purchasing additional service credit increases your monthly retirement benefit for the rest of your life. You can purchase between one and 60 months of service credit in whole months. Purchasing service credit will increase your monthly benefit, but it will not increase the years of service posted on your account. The increase to your benefit is calculated using the same formula as your retirement benefit. This additional service credit is available at the time of your retirement only. Also, you cannot use the additional credit to qualify for retirement (it won’t increase your years of service).

More about the service credit annuity

When can I purchase?

When you are retiring.

Are there limits to the amount of service credit I can purchase?

Minimum: One month; Maximum: 60 months.

How much does it cost?

Log in to your account and choose “Purchasing Service.” Here you can find the estimated cost and income increase per month you purchase.

What funds can I use to purchase service credit?

You can use any funds except for Plan 3 contributions. Funds rolled over from your DCP account must be pretax.

When does my annuity benefit begin?

After you have made payment in full.

How often do I receive the benefit?

Monthly.

Can I designate a survivor?

Yes. Your survivor will be the same option you chose for your retirement benefit.

Will I receive a Cost-of-Living Adjustment (COLA)?

Yes. You will receive a COLA up to 3% annually. If you’re a TRS Plan 1 or PERS Plan 1 member, a COLA is an optional choice at retirement.

Can I cancel the annuity if I change my mind?

No. Annuities are fixed income sources. Once you purchase the annuity, you will not have access to the funds you used to make the purchase. If you have not completed the annuity purchase, you can still change or cancel the annuity.

How do I purchase service credit?

Request this annuity when you retire online. You can also purchase it when completing a paper retirement application.

Will my annuity purchase be refunded when I die?

Yes. If you (and your survivor if you selected a survivor option) die before the amount of your purchase has been paid back to you, the difference will be refunded to your beneficiary. For TRS Plan 1, this refund does not apply if you selected the Maximum Option.

What if I return to work?

The return to work rules for service credit are the same as your retirement benefit. If you return to work for a DRS-covered employer, your annuity will stop if you return to retirement system membership or if you exceed allowable hours as a retiree (867 per year). If you do not return to a DRS-covered employer, your annuity will continue.

When will my benefit increase be effective?

The increase in your benefit will be effective the day after the department receives your full payment.

See a live or recorded annuity option webinar.

Life events that can affect your pension

Death

Death of a retired member

Please contact DRS as soon as possible. If the retiree chose a survivor benefit, we must update the account for payments to continue. If the retiree did not select a survivor option, we need to stop monthly benefits to avoid an overpayment.

When you contact us, please be ready to provide the deceased retiree’s:

- Full name

- Social Security number

- Date of death

We’ll also ask who is handling the affairs for the estate.

Report a death to DRS

Online: Report the death online.

Phone: 360-664-7081, Option 1

Email: drs.moddnd@drs.wa.gov – Please provide only the last 4 digits of the deceased’s SSN

Mailed form: Print and mail this death reporting form to DRS.

Death of an active or not yet retired member

If the deceased worked in a public service position in Washington, payment may be due to survivor(s). When you contact us, please be ready to provide the deceased member’s full name, Social Security number and date of death. Also tell us if the death may be work-related.

Death of a beneficiary or survivor

If you are an active member, you can update your beneficiary designation at any time by logging into your online account.

If your named survivor dies after you retire, you can have your pension benefit changed to the single-life option with no survivor reduction. You will need to report the death to DRS. This provision applies to all DRS plans except for LEOFF and WSPRS Plan 1, which have different survivorship options.

Disability

If you become totally incapacitated and leave your job as a result, you might be eligible for a disability retirement benefit. The disability retirement was originally created for customers who wouldn’t otherwise be eligible to start receiving a retirement benefit. Even if you have not yet reached the minimum age for retirement, or you are not yet vested in your plan, you can still apply for a disability retirement.

Do you already qualify for retirement?

If you are vested in your plan and qualify to retire, there is no financial benefit to taking disability vs retirement, even for early retirement. The income you receive for either retirement uses the same calculations. Early or full retirement is also a much faster process than disability retirement.

How to apply for a disability retirement

Call DRS and request an official estimate for a disability retirement. It takes about 3-4 weeks for DRS to calculate your benefit. Then we will mail you a packet with the estimate and a three-part form. You, your employer and your doctor will need to complete all three forms in the packet.

Once DRS receives the completed application and all supporting documentation, it usually takes about four to six weeks to determine your eligibility for a disability retirement.

The full application process averages 4-5 months from the time you request the estimate, but the timing can vary. Providing all requested documentation along with a complete application can help reduce the wait time.

If the disability retirement is approved, your retirement date would be the first of the month after your separation date. DRS would issue your monthly benefit payments on the last business day of the following month and every month after.

Separation and Withdrawals

Separating

If you separate from TRS employment, you can either withdraw your funds, retire if you meet eligibility requirements or leave your funds in the plan if you are vested for a future retirement. You can also leave your funds in the account if you have a balance of more than $1,000. If you are inactive and non-vested with a balance of less than $1,000, DRS is required to close your account and return the funds to you. The IRS requires you to start receiving your monthly benefit by age 73, unless you are still employed.

Separating from TRS-covered employment is the only circumstance where you can withdraw your contributions. Doing so cancels any rights and benefit you have accrued in TRS. You can restore your contributions and re-establish your benefit only in certain circumstances.

There are tax implications to withdrawing your contributions, so you might want to contact the IRS or a tax advisor before making a decision.

Be sure to keep us up to date on any changes to your name, address or beneficiary. It’s important that you keep your beneficiary designation current, because a divorce, marriage or other circumstance might invalidate it.

For more information about your options when separating, see this short career transitions video.

Service credit is cumulative

The service credit you earn toward vesting is cumulative. This means if you separate but later return to public service, you can continue to earn service credit toward your vested status even if you didn’t yet qualify when you separated. For Plan 1 and Plan 2 members, withdrawing your contributions when you separate will set your service credit years to 0.

Withdrawals

For information about withdrawing your retirement contributions before retirement, see Withdrawal of Retirement Contributions.

Withdrawal amounts are based on your total contributions made from your paychecks, plus accumulated interest. See below for information on regular interest.

Current and historical rates of regular interest

| From this date | Through this date | Member rate |

|---|---|---|

| 7/1/2022 | Present | 2.75% (current rate) |

| 1979 for most systems* | 6/30/2022 | 5.5% |

Loans and borrowing

Due to Internal Revenue Service regulations regarding government pension plans, none of the state retirement pension plans allow for loans or borrowing from your contributions. Retirement plan members, you can only access the funds you’ve contributed if you have separated employment from a DRS-covered employer.

The Washington Deferred Compensation Program (DCP) does not allow loans. If you have a DCP account, an Unforeseeable Emergency Withdrawal may be possible under certain criteria. More about DCP emergency withdrawals.

If you need to show proof of your account balance or monthly pension payment to secure a home loan, mortgage or other borrowing, log in to your DRS online account to view, print or download an account balance or pension verification letter.

Returning to public service

Returning

If you leave your position, withdraw your contributions and later return to work covered by TRS, you might be able to restore your previous service credit. To do so, you must repay the total amount of the contributions you withdrew plus interest within five years of returning to work or before you retire, whichever comes first. Contact us to find out that amount.

A dual member, or someone who belongs to more than one retirement system, might be able to restore service credit earned in a retirement system other than TRS. Each time you become a dual member, you’ll have 24 months to restore service credit earned in a previous retirement system.

It might still be possible to purchase service credit after the deadline has passed. However, the cost in that case is considerably higher. To explore financial projections and comparisons of your estimated retirement benefits, try using the Plan Choice Calculator.

Retired? See working after retirement.

Missing or withdrawn service credit

Service credit is the time used to calculate your pension retirement income. Sometimes customers notice their service credit doesn’t match their seniority date—these times do not always match. Often, the difference is because of missing or withdrawn service credit. You may be eligible to purchase some or all of the missing credit. Here is what you need to know about the process.

How do I check my service credit?

View your complete service credit history through your online account. It is a good practice to check your service credit every few years to be sure it matches your expectations.

Contact DRS for a cost estimate

You will need to contact DRS to request a cost for restoring your credit. We are not able to provide an estimate when you call. Similar to a retirement benefit estimate, this cost must be calculated by DRS and may require information from your employer.

You’ll need this information

The following preparation can expedite your request:

Provide the dates for the missing service. Find your service credit history in your online account.

Let us know if there is a gap in your service credit or if you withdrew from your account.

- If there is a gap in your service credit, do you know why? Were there any special circumstances around your employment at the time? Some common events for missing credit include: authorized leave of absence, childbirth, substitute teaching, temporary duty disability, or injury.

- If you withdrew from your account, when did you pull out the contributions?

How do I pay?

Make direct payment with either a personal or cashier’s check. Or in many cases it’s also possible to transfer funds from another eligible retirement account to purchase service credit. However, DRS cannot accept funds in excess of the cost to make your purchase. Check with your account administrator to see if you can transfer those dollars to a 401(a) account type.

There is a deadline

You must request and purchase the missing service within the timeframe allowed for your plan. The amount of time varies by plan. Ask DRS about your options for purchase. If the deadline has passed, you may still have the option to purchase additional service credit as an annuity option when you retire. This purchase will not restore missing time, but it would be used in your retirement payment calculation.

Retired members

The retiree resources page includes the following:

- Annual COLA updates

- Pension payment schedule

- How to get a proof of income letter

- And more

Working after retirement

How will your retirement income be affected if you return to work? It depends on where you work and how many hours.

You fully separate from employment

You must separate from employment. This means you must wait at least 30 consecutive days after your effective retirement date before returning to work and not have any pre-arranged agreement to return to work before retiring. If you return to work for a DRS-covered employer in any capacity before 30 days have passed, your benefit will be reduced.

If you return to work for a DRS-covered employer before your effective retirement date, your retirement application will be cancelled and you will continue to make member contributions.

How many hours are you working?

If you’re going to work less than 867 hours in a calendar year, your benefit won’t be affected. If you return to work for an employer covered by one of the state retirement systems in a DRS eligible position, your benefit could be affected if you work more than 867 hours per year. Your employer can tell you whether your position is eligible.

Working for a non-DRS covered employer

Unless you’ve been approved for a disability retirement, you can return to work for an employer not covered by a Washington state retirement system without affecting your monthly benefit.

Exceptions

Exceptions for nursing positions and school districts

New state laws allow some retirees to return to work up to 1,040 hours without affecting pension benefits. See the new exceptions.

See a live or recorded working after retirement webinar.

Members of more than one retirement plan

If you are a member of more than one Washington state retirement system, you are a dual member. You can combine service credit earned in all dual member systems to become eligible for retirement.

In most cases, your monthly benefit will be based on the highest base salary you earned, regardless of which system you earned it in.

Base salary includes your wages and overtime and can include other cash payments if those payments are included as base salary in all the retirement systems you are retiring from.

If you retire at age 65 with three years of service credit from TRS Plan 2 and four from the Public Employees’ Retirement System (PERS) Plan 2, you are a dual member. Without dual membership, your service wouldn’t be eligible for a monthly benefit from either system. With dual membership, your service credit is combined, giving you enough to retire. Your benefit is calculated with service from that system alone. Here’s the calculation:

2% x 3 (TRS service credit years) x Average Final Compensation (AFC) = TRS benefit

2% x 4 (PERS service credit years) x AFC = PERS benefit

TRS benefit + PERS benefit = total monthly benefit

See the multiple plans page for more information about dual membership.

See a live or recorded membership in multiple plans webinar.

Military service

Do you have U.S. military service? If you leave or reduce your DRS retirement plan-covered employment to serve in the military, you could be eligible for restoration of missing retirement service credit. The amount of service credit you have directly affects your retirement income calculation.

There is a deadline

You must complete payment for the military service credit within five years of returning to DRS-covered employment, or before you retire, whichever comes first. After this time has passed, and if the service does not qualify for no-cost service, you will no longer be eligible to replace the service credit using the military credit program. However, you can still purchase the service credit for a much higher cost as an optional bill past the statutory deadline date up to the time you retire (RCW 41.50.165). The longer you wait, the more it costs.

How much will it cost?

You can apply to recover up to five years of interruptive military service credit (sometimes up to 10 years depending on your circumstance). If your military service was during a period of war or an armed conflict during which you earned a campaign badge or medal, you might be able to recover up to five years of service credit at no cost to you.

For other interruptive military service, you can apply to receive an optional bill for the retirement contributions you would have paid on your normal salary during that time. However, you must pay your optional bill within five years after you return to work, and you must be working for the same employer you left to serve in the military. If you don’t pay the bill within five years, you might still be able to purchase the service credit, but at a much higher cost.

How do I apply?

Contact DRS about a month and a half after you return to work to ask about recovering military service credit. You will then submit information, such as a copy of your DD214 service record, to help us determine your eligibility. DRS will review your account as well as the information you provide and notify you of our findings, including an optional bill if applicable. This usually takes 2-3 weeks.

Other ways to increase your retirement

Depending on the type of funds you have available, DRS has a couple of annuity purchase options to increase your monthly pension amount.

Marriage or divorce

Your retirement account can be affected by changes in your marital status. If you marry or divorce before you retire, you need to update your beneficiary, even if your beneficiary remains the same.

Marriage

If you are married when you retire, you choose from a few benefit options that can include retirement income coverage for your spouse if you die before them.

If you marry after retirement, you could be eligible to change your benefit option to add your spouse. You need to be married at least a year and request DRS add your spouse during your second year of marriage.

If you become widowed after retiring, you can have your benefit option changed to the single-life option with no survivor reduction. You will need to report the death to DRS.

See more about changing your survivor after retirement.

Contact DRS for more information.

Divorce or separation

Upon divorce or separation, your monthly benefit is not subject to sharing or division unless it is court-ordered. DRS could be required to pay a portion of your retirement account to satisfy a divorce agreement. This order is called a property division. The order could award an interest in your account to your ex-spouse, or split your account into two separate accounts.

For questions about a property division, or to start the process, contact DRS.

For further research on property orders, see WAC 415-02-500.

Transferring to TRS Plan 3

Each January, eligible members of Plan 2 can choose to make a permanent transfer to Plan 3.

Who is eligible? Active TRS Plan 2 members who began service before July 1, 2007.

To transfer from Plan 2 to Plan 3, complete a Member Transfer form and submit it to your employer in January. DRS will transfer your Plan 2 contributions, and any interest earned, to a Plan 3 investment account.

For more information about the differences between Plan 2 and Plan 3, see Plan Choice.

IRS federal taxes or limits on your benefit

Federal taxes on your benefit

Most, if not all, of your benefit will be subject to federal income tax. The only exception will be any portion that was taxed before it was contributed. When you retire, we will let you know if any portion of your contributions has already been taxed.

Since most public employers deduct contributions before taxes, it’s likely your entire retirement benefit will be taxable.

At retirement, you must complete and submit an IRS W-4P form to let us know how much of your benefit should be withheld for taxes. If you don’t, DRS is required to withhold federal taxes as if you are single with no adjustments. To adjust your IRS tax withholding amount after retirement, log in to your online account or mail a new W-4P form to DRS.

For each tax year you receive a retirement benefit, we will provide you with a 1099-R form to use in preparing your tax return (see 1099-R). These forms are usually mailed at the end of January for the previous year. The information is also available through your online account.

It is your responsibility to declare the proper amount of taxable income on your income tax return.

If you opt to deduct health care from your monthly pension payments in retirement:

The IRS considers health insurance premiums paid via your monthly pension as part of your taxable income. This is because your pension contributions were not taxed (see IRS page 8). Visit the retired member page for more information about deductions in retirement.

Federal benefit limits for high income members

If you are a highly paid member or retiree, you may encounter a federal limit on your retirement benefit. There are two federal regulations that could limit benefits for highly paid members and retirees. The salary limit (which restricts the salary used to determine your benefit) and the benefit limit (which limits the annual benefit amount you can receive). In other words, federal law limits the amount of compensation you can pay retirement system contributions on, and that can be used in your benefit calculations. The IRS can adjust the amount each year.

2025 salary limit

The 2025 limit is $350,000. This means any salary you earn over this amount in 2025 will not be part of your retirement contributions or your pension calculation. See the following section for more information on how this limit applies to you.

Internal Revenue Salary Limit for Active Members

If you began public service before 1/1/96

- You don’t have a salary limit

- You pay contributions on all salary earned

- DRS does not adjust your Average Final Compensation for limit testing purposes

- Your pension calculation is not affected by salary limits

- IRC section 415(b) requires that your annual benefit must not exceed the limit. If you don’t exceed the benefit limit at the time you retire, it is still possible that your benefit may be affected at a later date.

If you began public service on or after 1/1/96

- The current year salary limit applies (see above)

- The salary limit is the same for all members and is adjusted annually by the IRS

- If you reach the salary limit in a calendar year, you stop paying contributions

- DRS notifies your employer when you approach the salary limit

- Your Annual Final Compensation is capped for limit testing purposes if it includes the years you exceeded the salary limit

- Your pension calculation is affected by salary limits

How do survivors or beneficiaries impact the limit?

Does my benefit amount change for my survivor beneficiary after I die?

No. If you chose to provide for a survivor beneficiary, and you die before your survivor does, your benefit transitions to your survivor at the rate you chose (100%, 50% or 67%). After the transition, your survivor’s benefit will also be tested.

What happens if my survivor beneficiary dies before I do?

If your survivor beneficiary dies before you do, your benefit increases as if you hadn’t chosen a survivor option. If your survivor beneficiary was your spouse or domestic partner, we will continue to use your original benefit amount in your annual testing. If your survivor beneficiary was not your spouse or domestic partner, we will use your new, higher limit amount in your annual testing.

More information about federal limits

The IRS characterizes the retirement systems as 401(a) defined benefit plans. To retain status as qualified plans, the systems must comply with federal regulations. For more information about salary limit regulations, see Internal Revenue Code (IRC) Section 401(a)(17). For more about benefit limit regulations, see IRC 415(b).

For more information see these IRS resources:

More about TRS Plan 2

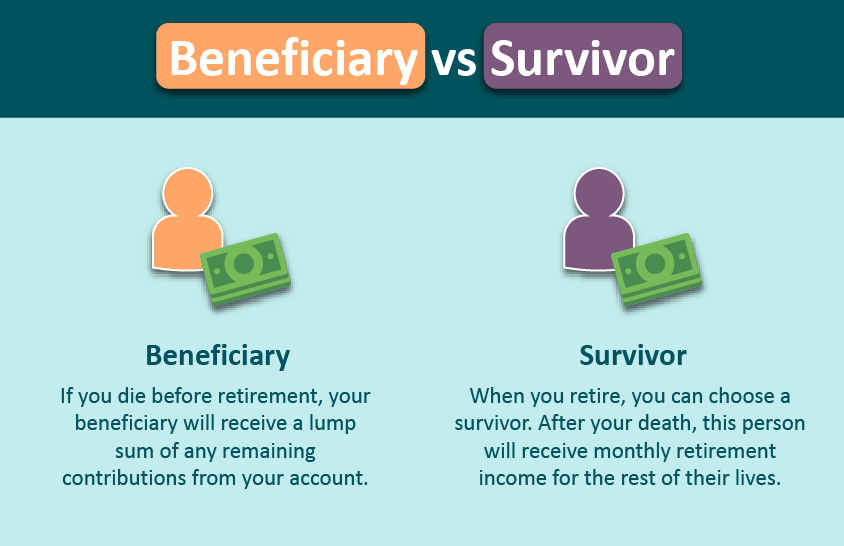

Selecting a beneficiary

The beneficiary information you give DRS tells us the person(s) you want to receive your remaining benefit, if any, after your death. Submit or update your beneficiary information at any time before retirement using your online account. Or you can submit a paper beneficiary form.

If you don’t submit this information, any benefits due will be paid to your surviving spouse or minor child. If you don’t have a surviving spouse or minor child, we will pay your estate.

Be sure to review your beneficiary designation periodically and update it in your online retirement account if you need to make a change. If you marry, divorce or have another significant change in your life, be sure to update your beneficiary designation because these life events might invalidate your previous choices.

State-registered domestic partners, according to RCW 26.60.010, have the same survivor and death benefits as married spouses. Contact the Secretary of State’s Office if you have questions about domestic partnerships.

Visit the beneficiary page for more information.

Your survivor benefit options

When you apply for retirement, you will choose one of the four benefit options shown below. If you choose a survivor benefit option, you must send a copy of a proof-of-age document, such as driver license or passport, when you apply for retirement. Once you retire, you can change your option only under limited circumstances.

Option 1: Single Life

This option pays the highest monthly amount of the four choices, but it is for your lifetime only. No one will receive an ongoing benefit after you die. If you die before the benefit you have received equals your contributions plus interest (as of the date of your retirement), the difference will be paid in a lump sum to your designated beneficiary.

Option 2: Joint and 100% survivor

Your monthly benefit under this option is less than the Single Life Option. But after your death, your survivor will receive the same benefit you were receiving for their lifetime.

Option 3: Joint and 50% survivor

This option applies a smaller reduction to your monthly benefit than Option 2. After your death, your survivor will receive half the benefit you were receiving for their lifetime.

Option 4: Joint and 66.67% survivor

This option applies a smaller reduction to your benefit than Option 2 and a larger reduction than Option 3. After your death, your survivor will receive 66.67% (or roughly two-thirds) of the benefit you were receiving for their lifetime.

Survivor options

Get real time examples of how your survivor option could affect your retirement benefit. Log into your online account and select the Benefit Estimator tool.

Example

Your pension benefit amount will depend on the survivor option you choose at retirement. Here is an example of the options for a monthly pension of $2,122. Your own numbers will differ depending on your plan, average salary and years of service. The birthdate of your survivor will also affect the calculations for the joint benefit options. In this example, the member and survivor are within 5 years of the same age.

- Single lifetime (no survivor benefit): $2,122 monthly benefit

- Joint and 100% survivor: $1,763 monthly benefit to you

(Your survivor would receive $1,763 monthly after your death) - Joint and 50% survivor: $1,926 monthly benefit to you

(Your survivor would receive $963 monthly after your death) - Joint and 66% survivor: $1,869 monthly benefit to you

(Your survivor would receive $1,233 monthly after your death)

After you (and any survivor) die, any remaining funds would be paid to your beneficiaries.

View this example as a graphic. Review your own pension income forecast using the Benefit Estimator tool in your online account.

Spousal agreement at retirement

If you have a spouse, legally separated spouse or registered domestic partner, your spouse must give consent as part of your retirement application if you: Choose Single Life Option 1 or name someone other than your spouse as your survivor. If spousal consent is required and you are unable to provide it, your application could be delayed. You will need to notify DRS, and an Option 3 benefit will be paid to you with your spouse designated to receive the survivor benefit. You will be able to print out a spousal consent form after you complete your retirement application online or it will be included with your retirement application.

See a live or recorded benefit options webinar.

Rollovers

What is a rollover? A rollover is moving funds from one eligible retirement plan to another. Rollovers can include a rollover out (moving funds out of an account) and a rollover in (moving money into an account).

You can roll out your pension account contributions, DCP and Plan 3 investment balances at any time once you separate from service. Pension plan contributions made by your employer are not eligible for rollovers. These dollars remain in the pension trust fund and are only available to you as part of a monthly pension retirement income.

While DRS doesn’t charge fees for rollover services, your other financial institutions could. Make sure you’re aware of any fees or differences in expenses, options and services before you move your funds.

Converting a cash withdrawal to a rollover

If you make a cash withdrawal, you’ll have 60 days from the date you receive payment to deposit the funds into a traditional IRA or another eligible plan that accepts rollovers. Your rollover in amount must match the rollover out amount before taxes or the difference is subject to income tax. You may choose to pay the difference out of pocket when you roll it over. This difference could be recovered when you file your annual tax return with the IRS. Consult your tax advisor or visit this IRS page to find out more.

Rolling funds out

Your account contributions and interest can be rolled out once you separate from service. Complete the withdrawal process for your plan. It is your responsibility to confirm whether your chosen institution will accept rollover funds.

When considering whether to roll your contributions out of your plan, find out how much service credit you’ve earned. If you have at least five years, you qualify for a guaranteed monthly pension in retirement. Retiring with the pension is the only way to receive the contributions your employer has also been adding to your plan. Plan 2 members who withdraw or rollover their contributions will forfeit their pension.

You can begin the rollover process by completing the Plan 1 and Plan 2 Pension Withdrawal form.

Rolling funds in

Generally speaking, you cannot roll funds into your retirement benefit account. However, there are some unique circumstances which would allow you to do so. For example, you can roll funds in to purchase service credit or an annuity. Using rollover funds to make these purchases would be reported as a rollover for tax purposes. If you have service credit available to recover or purchase, contact DRS to find out more about your options.

Washington’s Deferred Compensation Program (DCP) does accept rollovers-in. More rolling funds into DCP.

Health insurance options

Ask your employer if you will be eligible for health insurance coverage through a program like the Public Employees Benefits Board (PEBB) once you retire. You can also call the Health Care Authority at 800-200-1004 or visit hca.wa.gov.

If you qualify for continuing coverage after retirement, you must meet strict timelines to apply or request a deferral. If you are not entitled to PEBB coverage, you might be eligible for health insurance your employer provides. For more information, consult your employer.

If you opt to deduct health care from your monthly pension payments in retirement:

The IRS considers health insurance premiums paid via your monthly pension as part of your taxable income. This is because your pension contributions were not taxed (see IRS page 8). Visit the retired member page for more information about deductions in retirement.

Visit the health care page for more resources.

Plan eligibility

In general, you are automatically a member of TRS if you are hired into an eligible teaching position. A TRS-eligible teaching position is normally compensated for at least 70 hours of work per month for at least five months between September and August.

A teacher is anyone who is certified to teach and is employed by a public school as an instructor, administrator or supervisor. This includes:

- State, educational service district and school district superintendents and their assistants

- School district and educational service district employees who the Washington Superintendent of Public Instruction certificated

- Any full-time school doctor a public school employs to provide instructional or educational services

Enrollment in your specific TRS plan (Plan 2 or Plan 3) depends on additional conditions, including your hire date and the plan you chose at the time you first went to work for a DRS-covered employer. might be optional.

If you are a classified substitute, your TRS membership is optional. If you are an elected or appointed official, your TRS membership might be optional.

If you have ever been a member in another of Washington’s public service plans, it is important that you contact us to confirm your eligibility and discuss your retirement options.

Substitutes

A substitute teacher is an employee of one of Washington’s public schools who is employed exclusively as a substitute for an absent employee or working in an ineligible position. As a substitute teacher, your membership in the Teachers’ Retirement System (TRS) is optional.

Am I eligible to obtain service credit?

To become eligible for membership if you’ve never been a TRS member, you must work as a substitute teacher for 70 or more hours per month for at least five months of a school year. Existing members do not need to meet the hours requirement for substitute work that occurred after establishing membership. You can request to purchase service credit for your past substitute work all the way back to the 1990-91 school year.

When can I apply for service credit?

Once the school year is over, you can apply for service credit and request a bill beginning in September of the next school year. You can apply for multiple service credit years at the same time. However, you will owe less interest if you purchase each year’s credit before February of the next year.

More about interest: To avoid paying interest on the contributions, submit this application between September and January of the school year following the one in which you worked. For example, if you worked during the 9/1/228/31/23 school year, submit your application between September 2023 and January 2024. If your payment is received after the last day of February, you will be charged interest.

Your TRS membership will begin on the date your substitute bill is paid in full. For existing members, your membership began on either the date you were first hired into a TRS-eligible position or the date your first substitute bill was paid in full.

I’m eligible and want to receive service credit. What should I do now?

Follow the steps below.

- Apply by completing this form. If you are a new member, carefully consider whether you want to join Plan 2 or Plan 3. Your choice is permanent. More choose a plan information.

- Send in copies of any quarterly reports for any school years before the 2004-05 school year, if applicable. For more recent years, each employer you work for during the school year reports your hours and earnings to the Department of Retirement Systems (DRS). However, they don’t deduct contributions from your pay.

- DRS will process your request. This step can take up to 10 business days from the date we receive your forms and any additional documentation. If approved, DRS will send you a substitute bill.

- Pay your bill in full.

When will I receive a bill?

Once DRS receives your application materials, we will look up the amount of service credit you are eligible to buy. Then we will send you a bill for the amount due.

Once you pay your bill in full, we will apply the service credit to your account. View your service credit balance in your online account.

How can I submit my payment?

Payment must be made in a full lump sum. You can make a direct payment with a personal check or cashier’s check. You can transfer funds from another of your eligible retirement accounts to purchase service credit.

The IRS classifies DRS plans as 401(a) accounts.

Will I owe interest on my bill?

The interest-free period lasts from September through February of the school year after the one for which you’re seeking service credit. If your payment is received after the last day of February, you will be charged interest on employer contributions. Plan 2 members will also be charged interest on the member contributions.

Must I submit quarterly reports?

You must submit a quarterly report if one of the following situations applies to you:

- You worked for a higher education employer, the Washington State School for the Deaf or the Washington State School for the Blind

- You are applying to purchase substitute service credit for a school year prior to the 2004-05 school year

For more recent years, each employer you work for during the school year reports your hours and earnings to DRS.

Quarterly reports must show the exact hours you worked as well as the compensation you earned each month. Your employer must sign the reports too.

What if I previously withdrew my TRS contributions?

If you were previously a member of TRS Plan 2 and withdrew your contributions, you can reestablish your membership.

To reestablish membership in Plan 2, you must work as a substitute teacher for five months for at least 70 or more hours per month during a school year. Then complete Substitute’s Application for Service Credit to receive a bill.

If you are a Plan 3 member and withdrew your defined contributions, you can continue to apply for service credit in Plan 3.

Is buying substitute service credit my best option?

Typically, yes. However, if you’re age 65 or older and vested, purchasing your current substitute service credit might not be your best choice. Please contact DRS to discuss your options.

Elected or appointed official

Elected officials and governor-appointed officials are eligible for Washington state retirement benefits, but membership is not required. You’re eligible to join if you’re a former member of one of the systems below, even if you’ve withdrawn funds from your retirement account. You can also join if you have never been a member of a retirement plan administered by Washington state.

- Public Employees’ Retirement System (PERS) Plan 1, 2 or 3

- Teachers’ Retirement System (TRS) Plan 1, 2 or 3

- School Employees’ Retirement System (SERS) Plan 2 or 3

- Law Enforcement Officers’ and Fire Fighters’ (LEOFF) Plan 2

If you were already a member of PERS Plan 1, 2 or 3, you will rejoin that plan. If you are already retired at the time you become an elected or governor-appointed official, you may choose to rejoin membership or stay retired. Your decision may affect your monthly benefit.

You are not required to belong to any retirement system because you serve in an elected or governor-appointed position. However, if you would like to become a member while in office, you must apply to the Department of Retirement Systems (DRS).

Your membership choice is final. Once you establish membership, you must remain a member until you separate from all eligible public employment. If you serve an additional term of office with the same employer without a break in service, you will remain a retirement system member until you end employment.

I know I want to join. How do I Enroll?

To enroll (or opt out of membership), complete this online application form, provide a copy to your employer and mail the original to DRS for processing. You can enroll at any time during your elected or appointed service. Your contributions will continue until you separate from employment.

If you enter membership after your current term of office has begun, it will be retroactive to the first day of your current term of office. You will be required to pay employee contributions plus interest back to the first day of your term.

How do elected and governor-appointed officials earn service credit?

The amount of service credit you earn helps determine the size of your retirement benefit. For each month that you earn at least 90 times the state minimum wage, you will receive service credit as follows:

- 90 or more hours = one service credit month

- At least 70, but fewer than 90 hours = .5 service credit month

- Less than 70 hours = .25 service credit months

You can earn no more than one service credit month in any calendar month, even if you are employed with another DRS-covered employer. If you don’t meet the 90 times state minimum wage requirement for that month, you will not earn any service credit. A minimum of 60 service credit months is required to become vested and eligible for a monthly retirement benefit.

Washington state minimum wage is adjusted each year. As of Jan. 1, 2024, minimum wage is $16.28 per hour; 90 times the Washington state minimum wage is $1,465.20 per month.

Each year, the Washington State Department of Labor and Industries (L&I) will make a cost-of-living adjustment (see the top of the page) to the minimum wage. The adjustment is based on the federal Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The new minimum wage will be announced on Sept. 30, and take effect Jan. 1.

Your contributions and retirement benefit

How service is calculated for state elected officials

- State elected officials earn one full credit for each month worked, regardless of hours worked.

Can you purchase credit for past terms?

You can purchase service credit for past elected terms, but you cannot purchase past service for governor-appointed terms.

What if you retired from a DRS plan before you were elected or appointed?

You can choose to remain retired or you can return to active membership.

- Remaining retired: You will be subject to the standard retiree return to work rules for your plan.

- Returning to membership: This will stop your ongoing benefit, but resume your contributions and service credit accumulation for a larger benefit when you reapply for retirement.

I am already a participating PERS member. What happens to my service credit?

If you are working in two eligible PERS positions, you will only be awarded one service credit in any calendar month while working in the two eligible positions. However, your pension could increase from your additional earnings as an elected official if both PERS positions are concurrently reported in your Average Final Compensation (AFC) period.

Can I receive credit for past service?

When you have established membership for your current term, you may have the option of purchasing service credit for any previous term or terms of office during which you were not a member. However, if you are a governor-appointed official, you aren’t eligible to purchase service credit for previous terms of governor-appointed service.

To receive service credit for any previous terms, you must pay the required employee and employer contributions and interest, as determined by DRS. Your employer may elect to pay the required employer contributions and interest for you. If you served multiple terms in office with different employers, or non-consecutive terms in office, you may purchase credit for each term independently. All past consecutive service with a single employer must be purchased.

Can I retire and retain my elected position?

You may retire during your term of office and continue serving in your elected position, if:

- In that position, you earn less than $34K (as of 2023) adjusted annually for inflation, and

- You abandon claims for credit for future periods of elected service

For additional assistance, contact the DRS Elected Official Team at 800-547-6657, extension 47966.

TRS 2 resources

Retirement terms glossary

Live webinars

Retirement planning seminars

Contact DRS

New employees

Account access help

Retired members

COLA information

Retirement checklist

Your feedback

Please share your experience visiting the website.

Your feedback helps inform content updates and improve menu navigation. For security reasons, please do not include personal information (such as your Social Security number) in your responses. We are unable to answer questions you submit here. For account help, contact DRS directly.