Best financial wellness tips for your age

When it comes to budgeting, you may have heard the term “Save more and spend less.” But sometimes that’s easier said than done. If you’re saving for retirement or a big purchase next year, the best idea is to create a plan and set a few goals. Whether you just started working or you’re a few years away from retirement, we have some resources to help you with your planning, anywhere on your financial journey.

Early career (age 18-35)

Compound interest

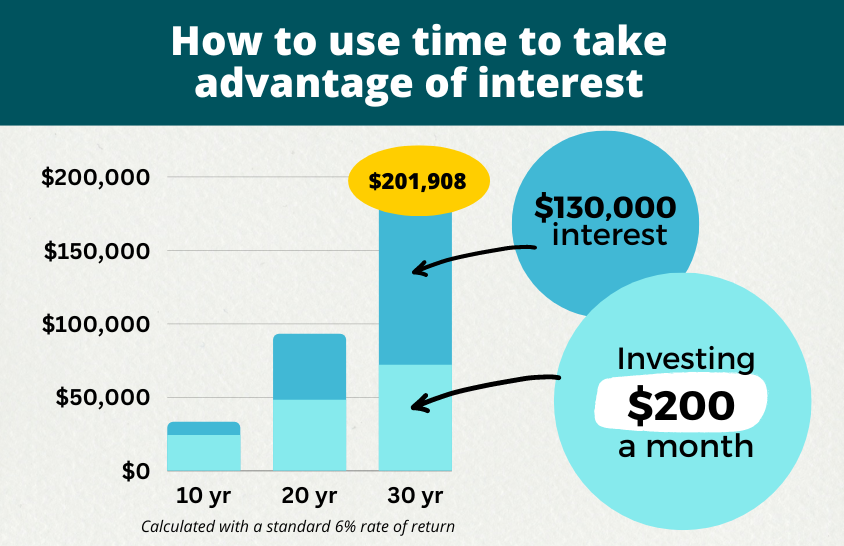

The earlier you start investing, the more money you’ll have in retirement. This is because of compound interest and the way it creates a snowball effect. It allows your money to grow faster, because you earn interest on your interest.

If you put $200 per month into a retirement account like DCP, your balance could grow to $201,908 in 30 years. The amount you gain will be small at first but get larger over time. That is why it’s so important to start early.

Here are the gains for a monthly $200 deposit at a 6% rate of return:

- $8,000 of additional earnings over 10 years

- $44,000 of additional earnings over 20 years

- $130,000 of additional earnings over 30 years

DCP calculator

Use the DCP calculator to estimate how much you’ll have in retirement with your current contribution. If you ever wished you could have a crystal ball to look into your financial future, look no further.

If you increase your monthly contribution by $100 or 1%, it makes a big difference over time.

Webinars

Watch a live or recorded webinar. Topics cover your retirement plan as well as tips for financial wellness. See the webinar schedule.

Mid-career (age 36-55)

DRS podcast

Listen to the new podcast: Fund Your Future with DRS. Now available on all listening platforms.

Explore some of the basics of financial planning, tools for managing your money and ideas for sparking conversations with friends and family. Join DRS employees as they tackle the stigma around money and share their personal financial journeys.

Benefit estimator tool

Log in to your online account and select “Benefit Estimator” to get an idea of your monthly retirement income. By answering a few simple questions, this tool will allow you to see what your monthly income could look like.

Financial independence checklist

Setting and maintaining your course toward financial independence could take less time than you think. The financial independence checklist has 5 easy steps you can take to set yourself up for success in retirement.

Near retirement (age 55+)

Retirement planning checklist

Find out what steps you need to take to retire with DRS.

Life lessons from those who’ve retired: If I knew then…

Retirement lingo

Beneficiary vs. Survivor

As a working public employee, you probably have a beneficiary listed on your account. However, when you retire, you can choose a survivor for your pension benefit. After your death, this person will receive monthly income for the rest of their lives.

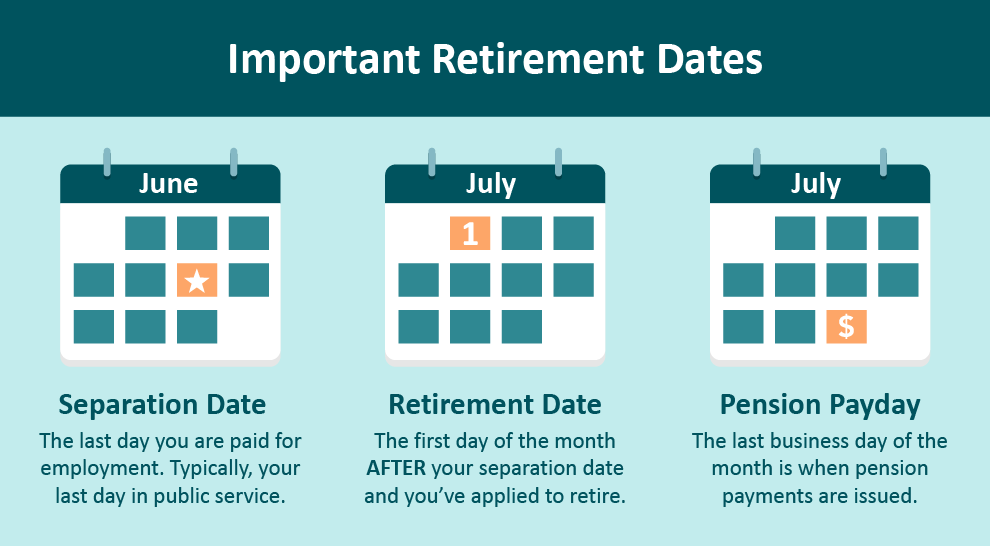

Separation vs. Retirement

Some members choose to start collecting their pension many years after they’ve separated from employment. Your official retirement date is the first day of the month after your separation date and you’ve applied to retire. Your Pension payday is the last business day of the month when pension payments are issued.

Those who are retired

We hope you’re enjoying this chapter of life. You could be traveling the world or spending some quality time at home with family. Either way, there’s a dedicated section to help you experience a secure, successful retirement.

Use your retiree resource page to:

- See the pension payment schedule

- Get the latest info on COLAs

- Sign up for retirement news from DRS

- Find out what happens to your pension if you return to work after retirement

For specific information, you’ll need to log in to your online account. Use your online account to:

- Update your address

- Update your direct deposit or tax withholdings

- Get statements and documents for taxes

More resources

Financial Wellness Video Library from VOYA

America Saves – A nonprofit that encourages and supports average-income households to save money, reduce debt, and build wealth.

DRS webinar schedule – Get information you can apply right now to plan for financial independence. Webinars are 30 to 60 minutes.